SniperPRO ATM

Trading Assistant

Advanced Trade Management

Strategy Templates:

| Setting | Default | Funded_Eval_Safe | OR_Breakout_Only | MeanRevert_Lite | TrendFollow_Pro | Conservative | Aggressive |

| TimesEnteredAreLocal | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

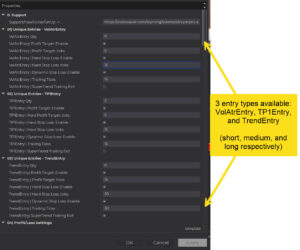

| VolAtrEntryQty | 1 | **0** | **0** | **0** | **0** | **0** | 1 |

| VolAtrEntryHardProfitTicks | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| VolAtrEntryMinProfitTicks | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| VolAtrEntryProfitTrailTicks | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| VolAtrEntryProfitTrailUseAtr | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| VolAtrEntryAtrMultiplier | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| VolAtrEntryHardStopLossTicks | 8 | 8 | 8 | 8 | 8 | 8 | 8 |

| VolAtrEntryTrailingTicks | 8 | 8 | 8 | 8 | 8 | 8 | 8 |

| EnableRealtimeVolAtrEntry | TRUE | TRUE | TRUE | **false** | TRUE | TRUE | TRUE |

| TP1EntryQty | 1 | **0** | **0** | 1 | **0** | **0** | 1 |

| TP1EntryHardProfitTicks | 20 | 20 | 20 | 20 | 20 | 20 | **28** |

| TP1EntryMinProfitTicks | 5 | 5 | 5 | 5 | 5 | 5 | **6** |

| TP1EntryProfitTrailTicks | 5 | 5 | 5 | 5 | 5 | 5 | 5 |

| TP1EntryProfitTrailUseAtr | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TP1EntryAtrMultiplier | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| TP1EntryHardStopLossTicks | 12 | 12 | 12 | 12 | 12 | 12 | **15** |

| TP1EntryTrailingTicks | 12 | 12 | 12 | 12 | 12 | 12 | **15** |

| EnableTP1EntrySuperTrendExit | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| EnableRealtimeTP1Entry | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| UseVWMA Crossing | TRUE | **false** | **false** | **false** | **false** | TRUE | TRUE |

| UseTC Crossing | TRUE | **false** | **false** | **false** | **false** | TRUE | TRUE |

| UseTC1 Crossing | TRUE | **false** | **false** | **false** | **false** | TRUE | TRUE |

| EnableRSI Crossing | TRUE | **false** | **false** | **false** | **false** | TRUE | TRUE |

| TrendEntryQty | 1 | 1 | 1 | **0** | 1 | 1 | 1 |

| TrendEntryHardProfitTicks | 80 | 80 | 80 | 80 | 80 | **60** | **100** |

| TrendEntryMinProfitTicks | 20 | 20 | 20 | 20 | 20 | **15** | 20 |

| TrendEntryProfitTrailTicks | 10 | 10 | 10 | 10 | 10 | **5** | 10 |

| TrendEntryProfitTrailUseAtr | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TrendEntryAtrMultiplier | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| TrendEntryHardStopLossTicks | 45 | 45 | 45 | 45 | 45 | **30** | **55** |

| TrendEntryTrailingTicks | 45 | 45 | 45 | 45 | 45 | **30** | **55** |

| EnableTrendEntrySuperTrendExit | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| EnableRealtimeTrendEntry | FALSE | FALSE | **true** | FALSE | **true** | FALSE | FALSE |

| UseSTCrossTrend Crossing | TRUE | TRUE | **false** | TRUE | TRUE | **false** | TRUE |

| UseTC2 Crossing | TRUE | TRUE | **false** | TRUE | TRUE | **false** | TRUE |

| ShowLabelsOpeningRange | FALSE | **true** | **true** | **true** | FALSE | **true** | **true** |

| ShowORH | FALSE | **true** | **true** | **true** | FALSE | **true** | **true** |

| ShowORL | FALSE | **true** | **true** | **true** | FALSE | **true** | **true** |

| EnableORBreakEntry | FALSE | **true** | **true** | **true** | FALSE | **true** | **true** |

| EnableORBreakEntryOnly | FALSE | **true** | **true** | **true** | FALSE | **true** | FALSE |

| emaCrossingsTemplate | FALSE | **true** | FALSE | **true** | **true** | **true** | FALSE |

| VolAtr/TP1 Entries: RSI Positioning Condition | TRUE | **false** | **false** | **false** | **false** | TRUE | **false** |

| VolAtr/TP1 Entries: TC Rising Condition | FALSE | FALSE | FALSE | **true** | FALSE | FALSE | TRUE |

| VolAtr/TP1 Entries: VWMA Positioning Condition | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| VolAtr/TP1 Entries: SuperTrend Condition | TRUE | **false** | **false** | TRUE | **false** | **false** | **false** |

| VolAtr/TP1 Entries: Volume Threshold Min | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| VolAtr/TP1 Entries: TC1 Rising Condition | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| VolAtr/TP1 Entries: RSIStrict Condition | FALSE | FALSE | FALSE | **true** | FALSE | FALSE | FALSE |

| VolAtr/TP1 Entries: Directional Thresholds | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| VolAtr/TP1 Entries: EnableTC1 Trade Gate | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| VolAtr/TP1 Entries: EnableAutoTrendDirection | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TrendEntry RSI Position Condition | FALSE | FALSE | FALSE | FALSE | FALSE | **true** | FALSE |

| TrendEntry SuperTrend Condition | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TrendEntry RSI Strict Condition | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TrendEntry TC1 Thresh/SuperTrend | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TrendEntry TC2 Trade Gate | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| TrendEntry TC2 Rising Condition | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE | FALSE |

| UseRthOpenRangeForMaxRange | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| MaxRangeTicks | 1500 | 1500 | 1500 | 1500 | 1500 | 1500 | **1800** |

| RthOpenRangeLookback | 55 | 55 | 55 | 55 | 55 | 55 | 55 |

| RthOpenRangeMinSamples | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| RthOpenRangeFactor | 5 | 5 | 5 | 5 | 5 | **4.0** | **10.0** |

| showMax | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| MinRangeTicks | 50 | 50 | 50 | **60** | 50 | 50 | 50 |

| PreferAoeOverMin | FALSE | FALSE | FALSE | **true** | FALSE | FALSE | FALSE |

| UseAoeTrail | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| PinFirstTrailAtAoe | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| AoeTrailBufferTicks | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| EnableLongEntries | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| EnableShortEntries | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| EmaTrendGate | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| EMA Trend Gate: RSI Strict Override | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| EmaTrendTfMinutes | 15 | 15 | 15 | 15 | 15 | 15 | 15 |

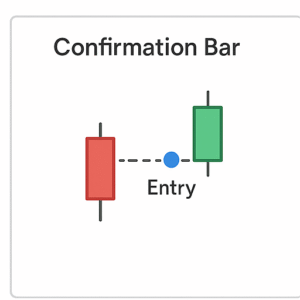

| EnableConfirmationBars | FALSE | FALSE | **true** | FALSE | FALSE | **true** | FALSE |

| EnableLongEntries | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| EnableShortEntries | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

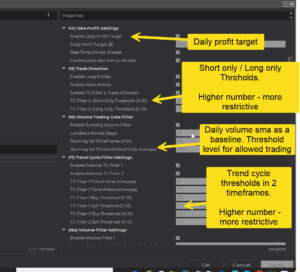

| AutoTrendShortOnlyThresh | 7.5 | 7.5 | 7.5 | 7.5 | 7.5 | 7.5 | 7.5 |

| AutoTrendLongOnlyThresh | 7.5 | 7.5 | 7.5 | 7.5 | 7.5 | 7.5 | 7.5 |

| UseAdaptiveAtrGate | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| UseSelfAdjustPL | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE | TRUE |

| MaxRangeTicksLimit | 600 | 600 | 600 | 600 | 600 | 600 | **800** |

| MaxRangePctReduce | 10 | 10 | 10 | 10 | 10 | 10 | 10 |

| volAtrBasePct | 25 | 25 | 25 | 25 | 25 | **15** | 25 |

| tp1BasePct | 50 | 50 | 50 | **35** | 50 | **30** | **45** |

| trendBasePct | 80 | 80 | 80 | 80 | 80 | **60** | **85** |

| MinProfitPct | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

| TrailPct | 40 | 40 | 40 | 40 | 40 | 40 | 40 |

| StopLossPct | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| DynamicStopLossPct | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| VolumeThresholdPct | 40 | 40 | 40 | 40 | 40 | **100** | **10** |

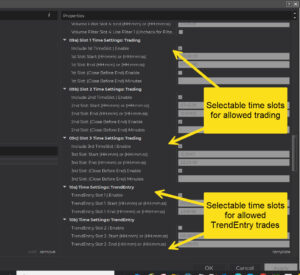

| StartTime | “08:35:00” | “08:35:00” | “08:35:00” | “08:35:00” | “08:35:00” | “08:35:00” | **”00:00:00″** |

| EndTime | “10:00:00” | “10:00:00” | “10:00:00” | “10:00:00” | “10:00:00” | “10:00:00” | **”23:59:59″** |

| SecondSlotStartTime | |||||||

| SecondSlotEndTime | |||||||

| ThirdSlotStartTime | “12:30:01” | **”13:20:00″** | “12:30:01” | “12:30:01” | |||

| ThirdSlotEndTime | “14:45:00” | **”14:20:00″** | “14:45:00” | “14:45:00” | |||

| FourthSlotStartTime | |||||||

| FourthSlotEndTime | |||||||

| TP1EntrySlot1Start | “08:35:00” | “08:35:00” | “08:35:00” | ||||

| TP1EntrySlot1End | “10:00:00” | “10:00:00” | “10:00:00” | ||||

| TP1EntrySlot2Start | **”12:30:01″** | **”12:30:00″** | |||||

| TP1EntrySlot2End | **”14:45:00″** | **”15:00:00″** | |||||

| TP1EntrySlot3Start | |||||||

| TP1EntrySlot3End | |||||||

| VolAtrTimeSlot1Start | “08:35:00” | **”08:35:00″** | |||||

| VolAtrTimeSlot1End | “09:30:00” | **”10:00:00″** | |||||

| VolAtrTimeSlot2Start | |||||||

| VolAtrTimeSlot2End | |||||||

| VolAtrTimeSlot3Start | |||||||

| VolAtrTimeSlot3End |

Expectations:

Setting up SniperPRO ATM Trading Assistant requires a bit of patience, but the reward is a powerful precision tool that can significantly enhance your trading performance. However, it’s important to understand that this is not a “set it and forget it” strategy. No such magical, always-winning system exists.

Success with SniperPRO comes from a disciplined, consistent approach—aiming for just a few quality trades each day. Over time, those small gains can compound into significant results. Embracing a mindset based on probabilities is essential.

Always apply your risk management rules, and be prepared for losses—they’re part of the process. For example, even with an 80% success rate (purely hypothetical, your results are based on personal ATM settings), you’d still expect 1 in 5 trades to result in a loss. The key is that 3 out of 5 trade sequences being net profitable can lead to long-term growth.

To put it into perspective: averaging just $100 per day could amount to nearly $25,000 per year, based on 243 trading days. With realistic goals and expectations, SniperPRO can become one of the most valuable tools in your trading arsenal and perhaps your best financial friend.

Note: Unattended trading is strongly discouraged.

Description:

SniperPRO ATM is a precision-engineered trading system designed for high-efficiency scalping. It leverages fundamental signals generated through trend cycle analysis across multiple timeframes. This volume-triggered strategy detects relative volume surges and executes trades in real time—tick by tick—for pinpoint entry and exit accuracy.

For swing traders, bar-on-close entries provide an alternative to momentum-based execution. While the core multi-timeframe trend-tracking algorithm remains the same, entry criteria can be tailored to suit non-momentum strategies, allowing for optimized positioning based on your specific trading style. This makes SniperPRO ATM a complete and highly adaptable solution for all types of traders.

The system also intelligently filters out poor trading environments by using daily average volume as a baseline, helping avoid low-volume, high-risk, and choppy conditions. All of this is powered by thousands of split-second calculations—ensuring speed, precision, and consistency in every market cycle.

Please consider the following points when deciding to use SniperPRO ATM:

-

No automated trading tool, including this one, guarantees trading success.

-

There is always a risk of significant financial loss, even when using algorithmic trading strategies.

-

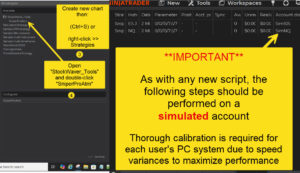

SniperPRO ATM is a precision tool that requires calibration and thorough testing, ideally in a simulated environment.

-

Unattended trading is strongly discouraged. Various factors, such as power outages or unexpected system failures with your PC or brokerage, may necessitate manual intervention.

-

By using this tool, you assume full responsibility for all potential outcomes and agree to hold StockWaver, the creator of SniperPRO ATM, harmless.

To fully convey the intended designed use of this algorithm, here is an excerpt from the “Apex Consistency Rules” page:

“Automation

AI, Autobots, Algorithms, Fully Automated Trading Systems or Software, High-Frequency Trading (HFTs), or any other automated trading is prohibited on the PA or Live accounts.

It is strictly prohibited to use any type of hands-off, set-and-forget, set-and-walk-away, trading continuously 24 hours a day, or any other type of automation, including those listed above. Using those types of automation will cause the closure of the PA or Live account and forfeiture of all funds and balances.

The use of semi-automated software must accompany full trader monitoring and presence at all times. This means the trader must be present, watching the trades and managing the entries and settings on the semi-automated software. This software assists in placing a trade based on a set of rules that the trader is actively monitoring, adjusting the software for market moves, longs, shorts, pausing, news awareness, market conditions, etc.

It is advisable to turn off and on semi-automated trading or a trade assistant as market conditions begin to set up for a trade or as they deteriorate. Remember, it is to be used to help with the speed or accuracy of placing a trade, not as a system that trades for you.”

Minimum PC System Requirements:

To run SniperPRO ATM Trading Assistant on NinjaTrader efficiently, your computer should meet or exceed the recommended specifications. Minimum requirements include a 1 GHz 64-bit processor, 2GB of RAM, Windows 10/11, and Microsoft .NET Framework 4.8. For optimal performance, especially with multiple charts and advanced features, consider a 2 GHz quad-core processor, 8GB of RAM, and an SSD.

Here’s a more detailed breakdown:

Detailed Requirements:

Operating System: Windows 10, Windows 11, or Windows Server 2016 or later (64-bit).

Processor: 1 gigahertz (GHz) or faster 64-bit processor.

RAM: 2GB.

Microsoft .NET Framework: 4.8.

Screen Resolution: 1024 x 768.

Graphics Card: A DirectX 10-compatible graphics card is highly recommended.

Recommended Specifications:

Processor: 2 GHz or faster quad-core 64-bit processor.

RAM: 8GB.

Graphics Card: DirectX 10 compatible.

Storage: SSD Hard Drive.

Factors Influencing Performance:

Number of Charts/Instruments:

A larger number of charts and instruments in your workspace can place a greater strain on your CPU and RAM.

Strategy Optimization:

Optimizing trading strategies, especially those with many parameters, can be resource-intensive and benefit from a faster processor and more RAM.

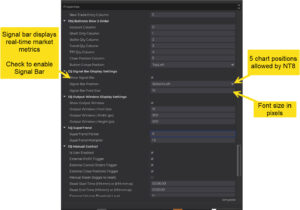

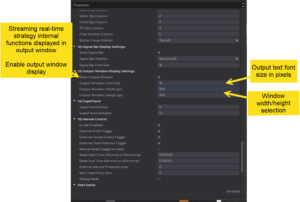

⚙️Calibration Settings: Preface

443332) SniperPRO ATM – Optimize for Peak Performance

Out of the box, SniperPRO ATM comes pre-configured with moderately conservative settings, designed to provide a solid foundation for trade generation and management. These defaults strike a practical balance—efficient enough for most users, yet flexible enough to adapt to various trading styles.

However, to unlock maximum performance and profitability, it is strongly recommended that users:

🧪 1) Test optional settings on your specific trading instruments.

💻 2) Fine-tune based on your machine’s performance—every computer system behaves differently and can affect the timing and precision of trades.

🧭 3) Use a simulated environment for all adjustments. This ensures risk-free experimentation while you optimize.

📈 4) Incrementally refine settings to achieve peak trade execution and strategy alignment.

💡 Pro Tip: Time spent on optimization isn’t just setup—it’s an investment. With careful tuning, you can exponentially increase both trade efficiency and profitability.

Important Note: Playback mode is not compatible with SniperPRO. While a Tick 100 chart might occasionally trigger executions, playback only processes entries at bar close, causing significant delays. This lag means playback results are highly inaccurate and do not reflect real-time performance—not even close.

Calibration Settings - Explained

Click on down arrow to open each section

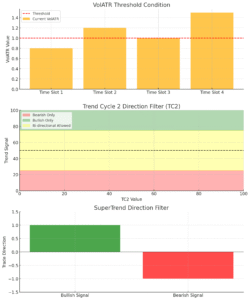

05) VolAtr Threshold, TC2 Trend and SuperTrend Directions Trade Conditions

Four Optional Trade Execution Conditions

In the strategy settings menu 05) Trade Condition, SniperPRO ATM includes four optional filters that must be met to pass the trade execution gate. These conditions help ensure higher-quality setups by aligning entries with market context and trend direction.

📈 1) VWMA Direction Condition (Require VWMA Positioning)

This setting enforces a crossed up/down direction of VWMA fast/slow lines, based on a user-defined lengths of volume weighted moving average values.

- The default lengths are: fast – 8 | slow – 13.

- When fast is crossed over slow: long trade allowed | fast under slow: short trade allowed.

- Directional momentum is typically poised in the direction of crossings.

- Default: On

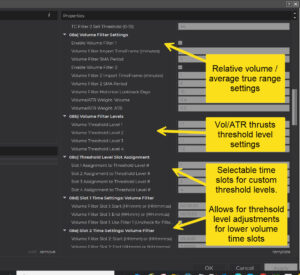

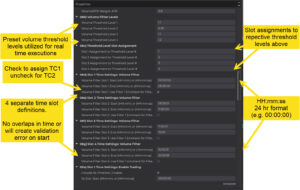

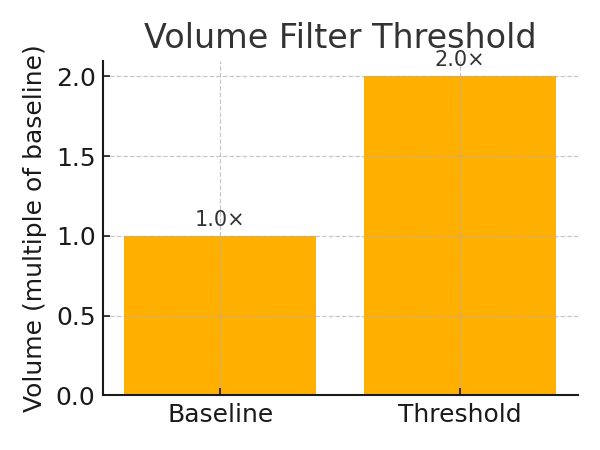

📈 2) VolATR Threshold Condition (Require VolATR Threshold Minimum)

This setting enforces a minimum Volume/ATR threshold, based on a user-defined multiplier of historical VolATR values collected by time of day.

- The baseline is set to zero.

- Four threshold levels can be configured and mapped to specific time slots.

- Trades are only allowed if the current VolATR meets or exceeds the specified threshold for that time slot.

- Default: Off (only applies to TP1Entry and TrendEntry on bar close entries)

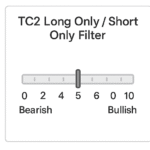

📈 3) Trend Cycle 2 Direction Filter (Require TC2 Trend Direction Condition)

- TC2 is a user-defined trend indicator calculated in real-time on a higher timeframe (default: 15 minutes), with values ranging from 0 to 100:

- A value near 0 indicates an extreme bearish trend.

- A value near 100 signals an extreme bullish trend.

This condition restricts trades to only occur in the same direction as the prevailing trend when TC2 is in extreme zones (typically below 25 for bearish or above 75 for bullish). - Bi-directional trading is permitted when TC2 is within the 25–75 range.

- Default: Off

📈 4) SuperTrend Direction Filter (Require SuperTrend Direction Condition)

This setting allows trades only in the direction of the active SuperTrend trend—bullish or bearish—ensuring entries are made in alignment with the current market momentum.

- Default: Off

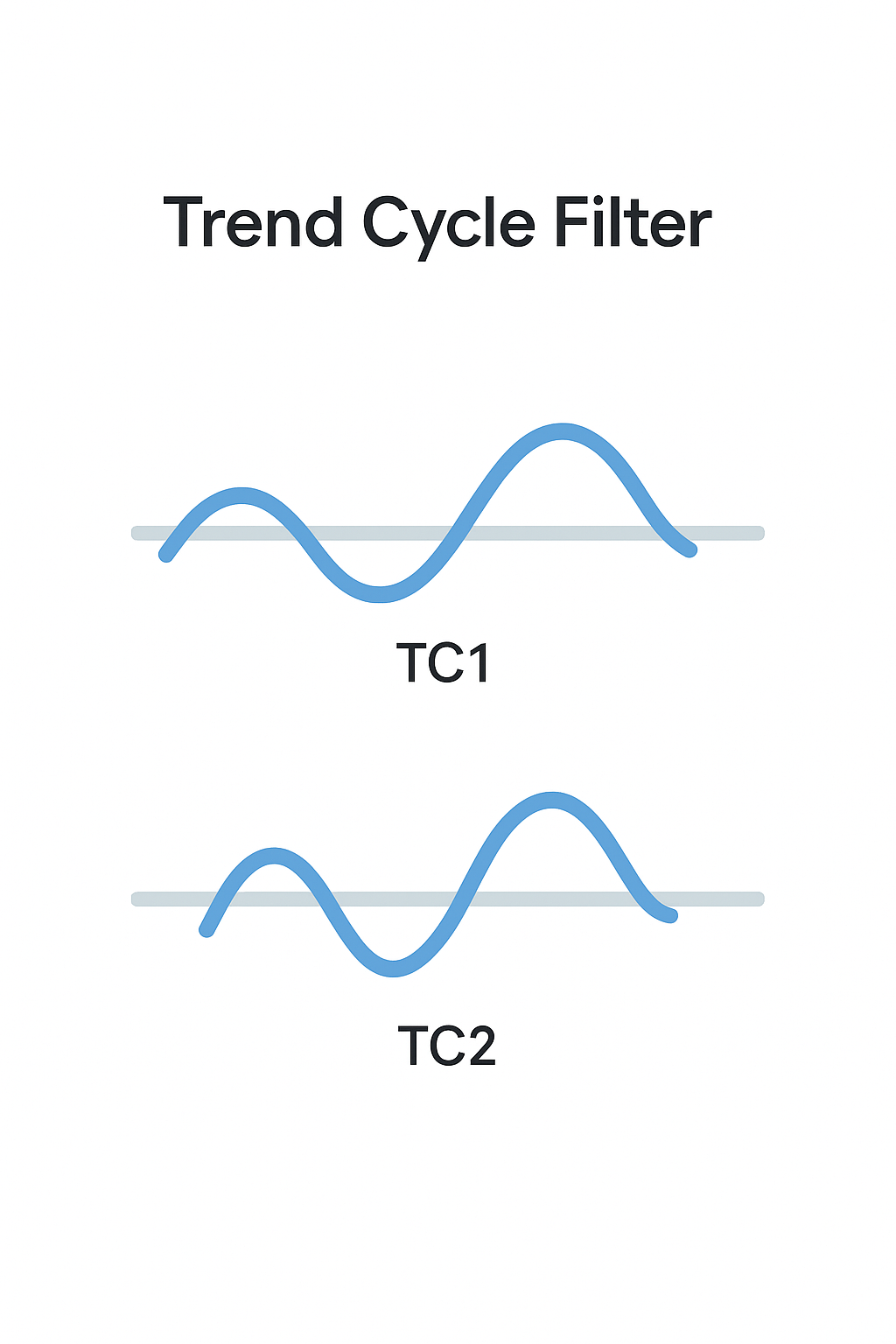

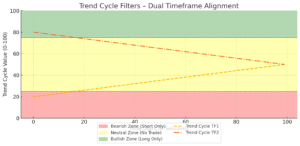

05) Trend Cycle Filters Trade Conditions

✅ Optional Trend Cycle Filter Conditions

In the strategy settings menu 05) Trade Condition, SniperPRO ATM includes two optional trend cycle filters that must be met to pass the trade execution gate. These conditions help ensure higher-quality setups by aligning entries with market context and trend direction.

05) Entry Types Conditions

🔄 Real-Time vs Bar-Close Entries

In the strategy settings menu 05) Trade Condition, these optional entry type conditions may be configured

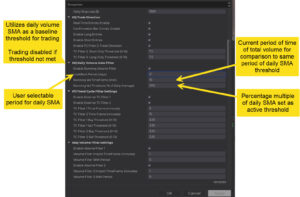

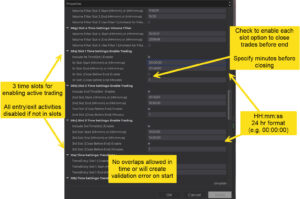

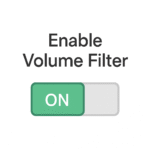

06) Daily Volume Gate Filter

📊 Daily Volume Gate

The Daily Volume Gate ensures trades are only taken when there is sufficient market activity, helping filter out low-volume conditions that can lead to unreliable setups This feature compares:

- The Current Running Volume (accumulated intraday volume)

- Against a Daily Volume SMA (Simple Moving Average of daily volumes over a lookback period)

By using this filter, SniperPRO dynamically restricts trades during below-average volume environments, increasing the reliability of momentum or trend-based entries.

⚙️ Key Settings Explained

✅ Enable Running Volume Filter

- Function: Activates the gate to restrict trades if the current volume is insufficient.

- Purpose: Prevents entries during thin or inactive market conditions.

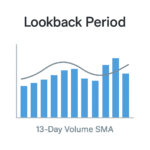

📆 Lookback Period

- Function: Sets how many previous trading days are used to calculate the Daily Volume SMA.

- Default: 13 days

- Effect: A longer lookback smooths the average; a shorter one makes the threshold more responsive.

📈 Running Volume Threshold

- Function: Sets the minimum required intraday volume as a percentage of the daily SMA to permit trade entries.

Default: 100% (i.e., trade only if current volume equals or exceeds the 13-day average)

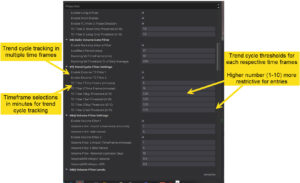

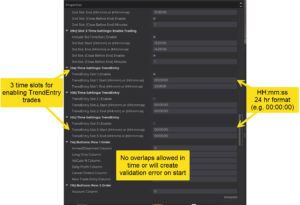

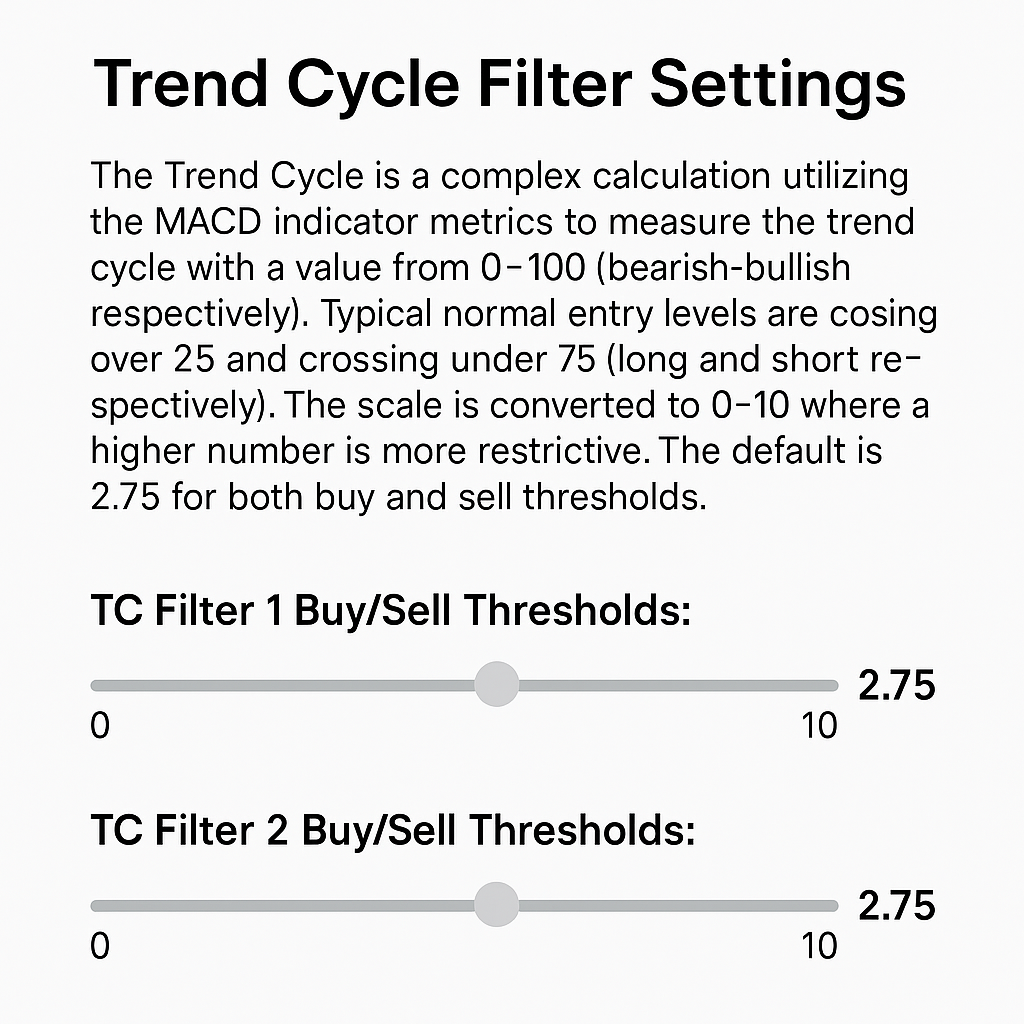

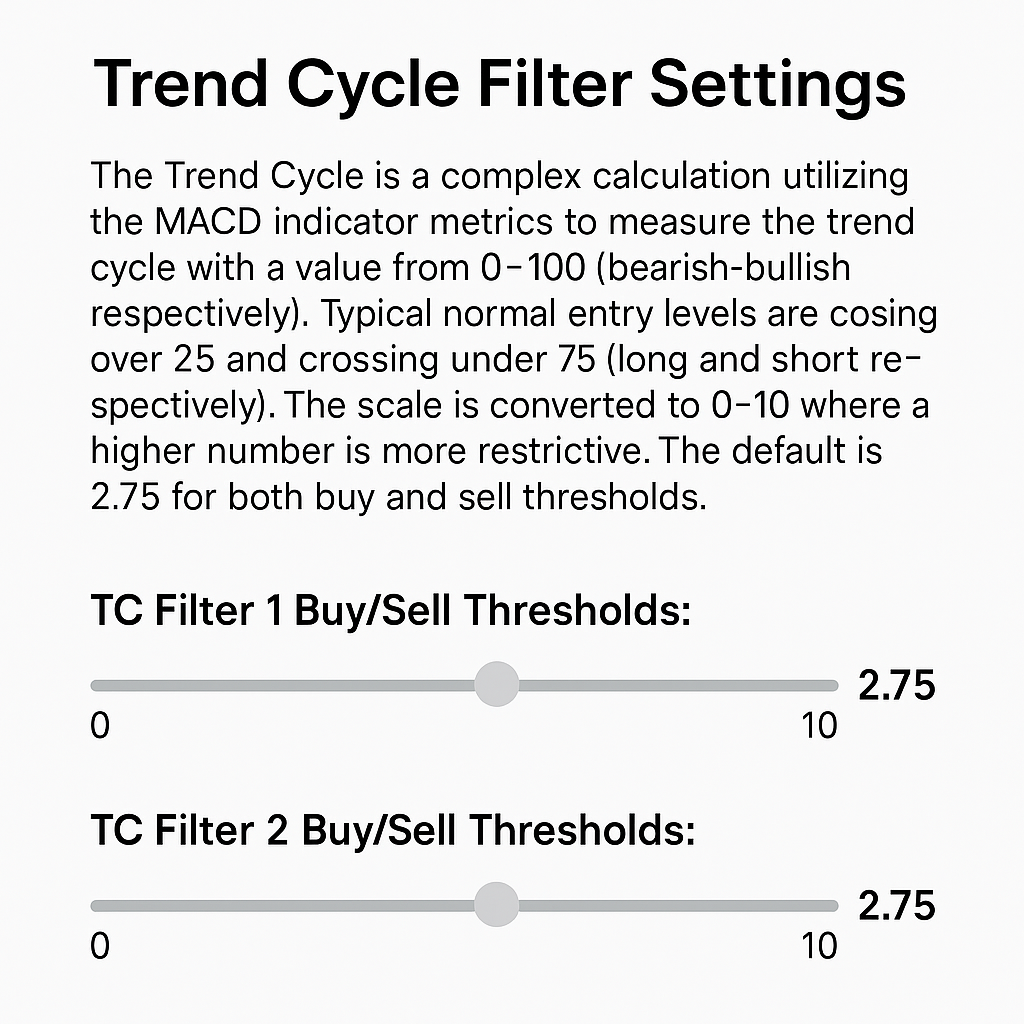

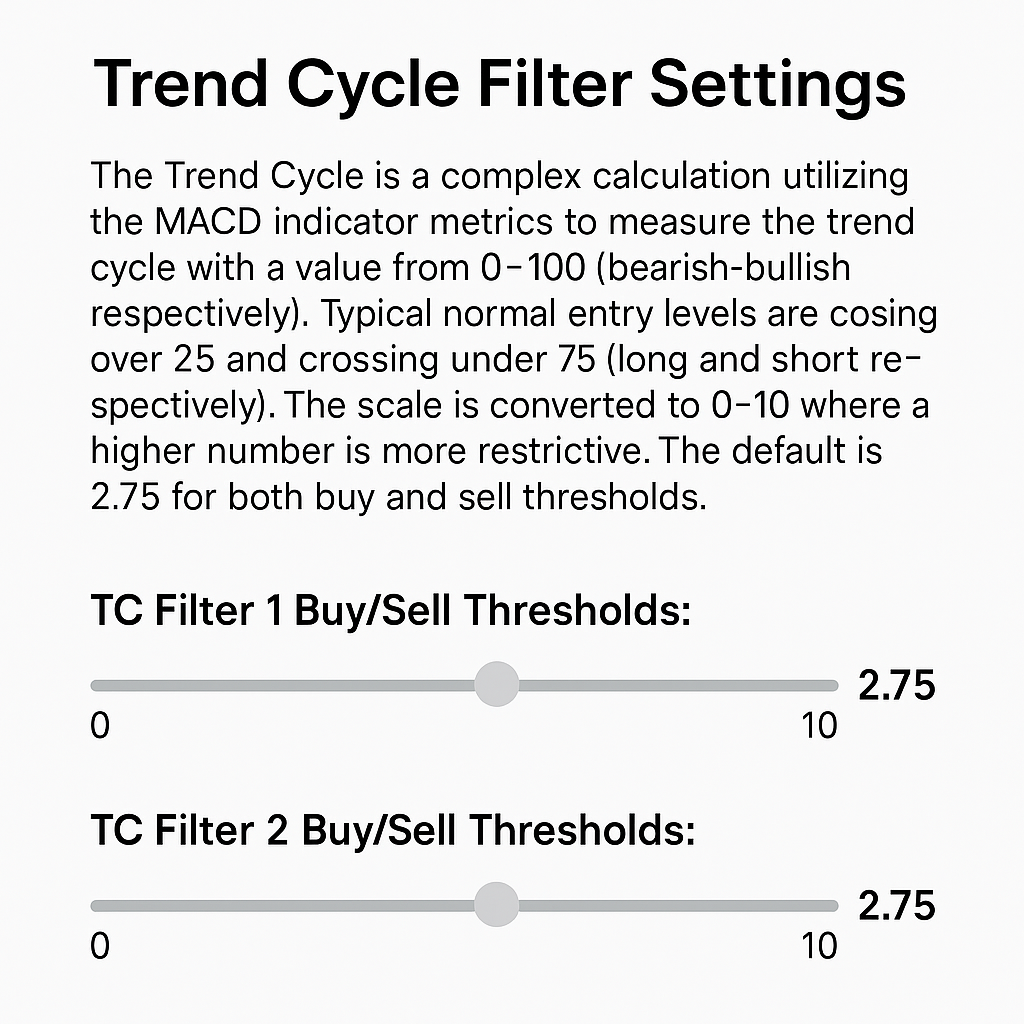

07) Trend Cycle Filter

🔁 Trend Cycle Filter – Smoothing Trade Direction

The Trend Cycle Filter is a refined market direction tool based on a modified interpretation of the MACD (Moving Average Convergence Divergence). It outputs a normalized value between 0 and 100, where:

- 0 = Strongly Bearish

- 100 = Strongly Bullish

For simplified tuning, this 0–100 range is rescaled to 0–10, where:

- Lower values = Less restrictive (more signals)

- Higher values = More restrictive (fewer, stronger signals)

📈 Entry Zone Logic

- Long entries: Trigger when trend crosses above 25 → ~2.5 on the 0–10 scale.

- Short entries: Trigger when trend crosses below 75 → ~7.5, or 2.5 again on an inverted scale.

🔧 Default threshold: 2.75 for both long and short filters across both timeframes.

⚙️ Settings Overview

🕒 TC Filter 1 & 2 Time Frames

- External timeframes used for calculating MACD trend cycles.

- Defaults: 5 minutes (TC1) and 15 minutes (TC2)

- Provides multi-timeframe filtering for more reliable trend confirmation.

🎚️ TC Buy/Sell Thresholds (0–10 Scale)

- Each TC filter has separate buy and sell thresholds.

- Higher numbers = stricter conditions, meaning fewer but higher-confidence trades.

- Recommended: Use the same threshold value for both buy/sell.

- Reference: A threshold of 2.5 ≈ crossing over 25 (buy) or under 75 (sell)

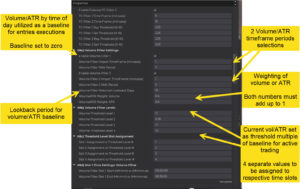

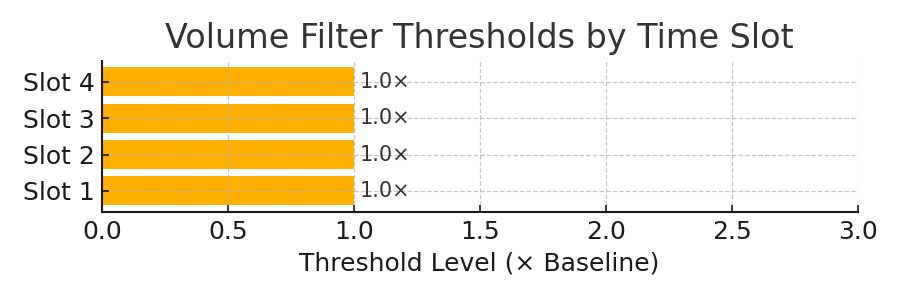

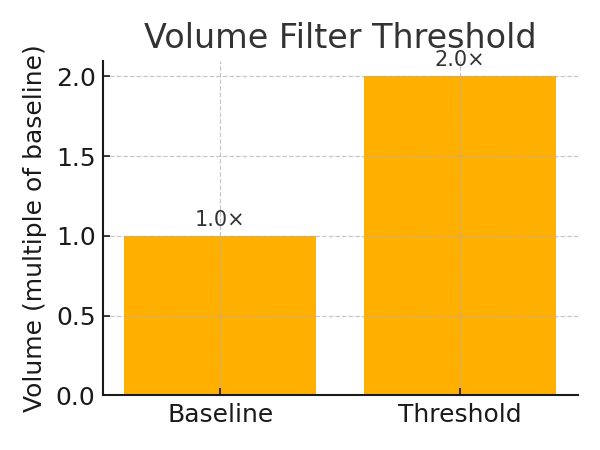

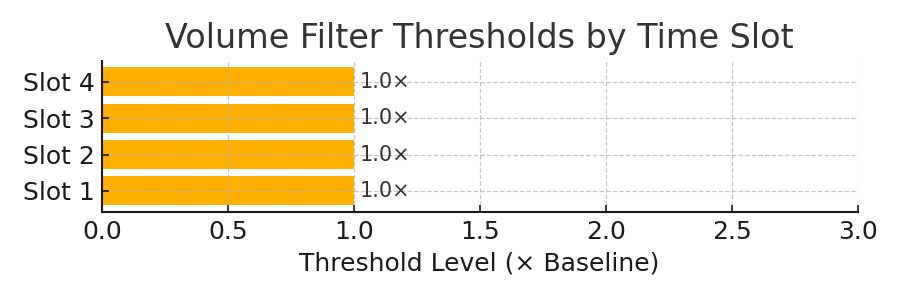

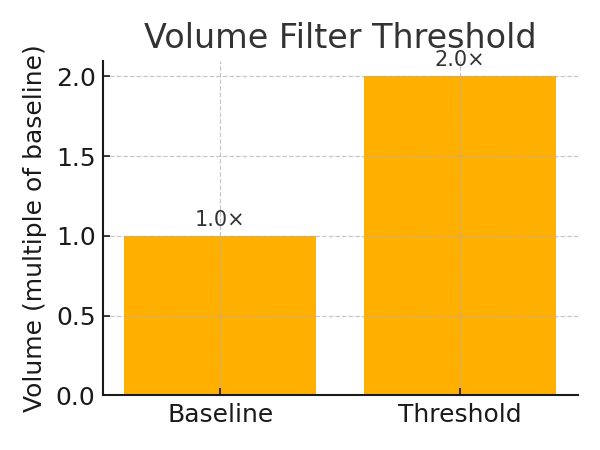

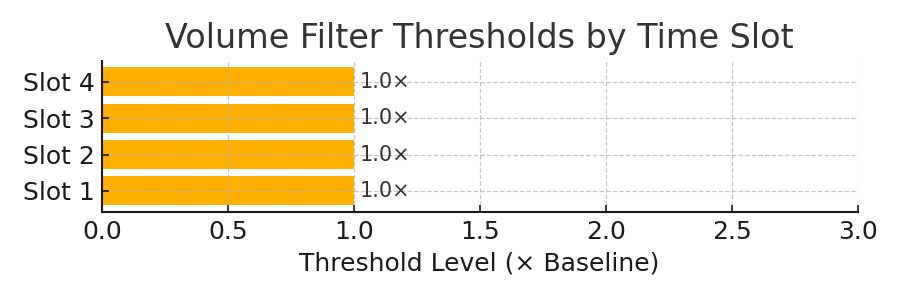

08a) Volume Filter Levels

📊 Volume Filter Levels – Adaptive Volume/ATR Gate

The Volume Filter protects momentum-based trades by requiring today’s intraday Volume ÷ ATR to exceed a time-of-day benchmark built from historical data.

How it works

| Concept | Explanation |

| Historical baseline | For every minute of the session, SniperPRO stores the average Volume ÷ ATR over the past N days (default N = 13). That average is treated as 1× baseline. |

| Threshold | You choose a multiple of the baseline that must be reached before entries are allowed. Internally the scale starts at 0 = baseline, so 1.0 means “2× the historical average” and so on. |

| Four daily slots | Up to 4 independent time windows (e.g., Open, Mid-day, Power Hour, Overnight) can each have its own threshold. Default for all four is 1.0. |

Key parameters

- Threshold 1-4 – minimum multiple (0 – ∞). Default 1.0

- Slot 1-4 start / end – optional daily time windows that map each threshold to the parts of the session you care about.

Tip: Keep thresholds aligned across slots when first calibrating; then tighten specific windows where fake breakouts are common.

⚙️ SniperPRO ATM Default Configuration Overview: highest probability | medium return

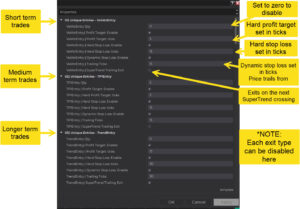

📌 01. Unique Entry – VolAtrEntry

| Setting | Value |

| Entry Quantity | 0 |

| Real-time Entries | ✅ Enabled |

🧠 VolAtrEntry: This momentum entry type is enabled but not actively placing orders (Qty: 0).

🎯 02. Unique Entry – TP1Entry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 10 |

| Hard Stop Loss | 30 |

| Dynamic Stop Loss | 30 |

| Real-time Entries | ❌ Disabled |

🧠 TP1Entry is configured with a tighter profit/stop setup—ideal for scalping.

📈 03. Unique Entry – TrendEntry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 20 |

| Hard Stop Loss | 60 |

| Dynamic Stop Loss | 60 |

| Real-time Entries | ❌ Disabled |

🧠 TrendEntry allows for wider risk/reward—fitting for trending conditions.

💰 04. Profit & Loss Controls

| Setting | Value |

| Daily Profit Target | ✅ Enabled – $1,000 |

| Daily Stop Loss | ✅ Enabled – $1,000 |

🔒 Capital protection and daily goal locking are both active.

🧪 05. Trade Conditions & Filters

| Condition | Status |

| VWMA Positioning Requirement | ✅ Yes |

| TC2 Direction Requirement | ❌ No |

| VolAtr Threshold Requirement | ❌ No |

| SuperTrend Requirement | ❌ No |

| TC Filter 1 Trade Gate | ✅ Enabled |

| TC Filter 2 Trade Gate | ✅ Enabled |

| Confirmation Bar Entries | ✅ Enabled |

| Long Entries | ✅ Enabled |

| Short Entries | ✅ Enabled |

| TC Filter 2 Directional Filtering | ✅ Enabled |

| TC Filter 2 – Short Only Threshold | 8.75 |

| TC Filter 2 – Long Only Threshold | 8.75 |

🔍 Multiple layers of filtering increase signal reliability and market alignment.

🚪 06. Daily Volume Gate Filter

| Setting | Value |

| volGate | 100 (% Daily Volume SMA) |

🔒 Prevents low volume trading based on factor of daily volume sma.

⚙️ SniperPRO ATM Moderate settings profile: higher trade frequency | moderated probability

*Changed = altered from default settings

📌 01. Unique Entry – VolAtrEntry

|

Setting |

Value |

|

Entry Quantity |

1 *Changed |

|

Real-time Entries |

✅ Enabled |

|

⏰Trade Time 10a) |

First 2 hours RTH (e.g. Eastern Time – start: 09:30:00, end: 11:30:00) |

🧠 VolAtrEntry: This momentum entry type should only be traded during high volume periods for consistency.

🎯 02. Unique Entry – TP1Entry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 10 |

| Hard Stop Loss | 30 |

| Dynamic Stop Loss | 30 |

| Real-time Entries | ❌ Disabled |

🧠 TP1Entry is configured with a tighter profit/stop setup—ideal for scalping.

📈 03. Unique Entry – TrendEntry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 20 |

| Hard Stop Loss | 60 |

| Dynamic Stop Loss | 60 |

| Real-time Entries | ❌ Disabled |

🧠 TrendEntry allows for wider risk/reward—fitting for trending conditions.

💰 04. Profit & Loss Controls

| Setting | Value |

| Daily Profit Target | ✅ Enabled – $1,000 |

| Daily Stop Loss | ✅ Enabled – $1,000 |

🔒 Capital protection and daily goal locking are both active.

🧪 05. Trade Conditions & Filters

| Condition | Status |

| VWMA Positioning Requirement | ✅ Yes |

| TC2 Direction Requirement | ✅ Yes *Changed |

| VolAtr Threshold Requirement | ❌ No |

| SuperTrend Requirement | ❌ No |

| TC Filter 1 Trade Gate | ✅ Enabled |

| TC Filter 2 Trade Gate | ❌ Disabled *Changed |

| Confirmation Bar Entries | ❌ Disabled *Changed |

| Long Entries | ✅ Enabled |

| Short Entries | ✅ Enabled |

| TC Filter 2 Directional Filtering | ✅ Enabled |

| TC Filter 2 – Short Only Threshold | 8.75 |

| TC Filter 2 – Long Only Threshold | 8.75 |

🔍 Multiple layers of filtering increase signal reliability and market alignment.

🚪 06. Daily Volume Gate Filter

| Setting | Value |

| volGate | 100 (% Daily Volume SMA) |

🔒 Prevents low volume trading based on factor of daily volume sma.

⚙️ SniperPRO ATM Medium settings profile: higher trade frequency | increased loss risk | balanced return

*Changed = altered from default settings

📌 01. Unique Entry – VolAtrEntry

| Setting | Value |

| Entry Quantity | 1 *Changed |

| Real-time Entries | ✅ Enabled |

| ⏰Trade Time 10a) | First 2 hours RTH (e.g. Eastern Time – start: 09:30:00, end: 11:30:00) |

🧠 VolAtrEntry: This momentum entry type should only be traded during high volume periods for consistency.

🎯 02. Unique Entry – TP1Entry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 10 |

| Hard Stop Loss | 30 |

| Dynamic Stop Loss | 30 |

| Real-time Entries | ❌ Disabled |

🧠 TP1Entry is configured with a tighter profit/stop setup—ideal for scalping.

📈 03. Unique Entry – TrendEntry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 20 |

| Hard Stop Loss | 60 |

| Dynamic Stop Loss | 60 |

| Real-time Entries | ❌ Disabled |

🧠 TrendEntry allows for wider risk/reward—fitting for trending conditions.

💰 04. Profit & Loss Controls

| Setting | Value |

| Daily Profit Target | ✅ Enabled – $1,000 |

| Daily Stop Loss | ✅ Enabled – $1,000 |

🔒 Capital protection and daily goal locking are both active.

🧪 05. Trade Conditions & Filters

| Condition | Status |

| VWMA Positioning Requirement | ✅ Yes |

| TC2 Direction Requirement | ✅ Yes *Changed |

| VolAtr Threshold Requirement | ❌ No |

| SuperTrend Requirement | ❌ No |

| TC Filter 1 Trade Gate | ✅ Enabled |

| TC Filter 2 Trade Gate | ❌ Disabled *Changed |

| Confirmation Bar Entries | ❌ Disabled *Changed |

| Long Entries | ✅ Enabled |

| Short Entries | ✅ Enabled |

| TC Filter 2 Directional Filtering | ❌ Disabled *Changed |

| TC Filter 2 – Short Only Threshold | 8.75 |

| TC Filter 2 – Long Only Threshold | 8.75 |

🔍 Multiple layers of filtering increase signal reliability and market alignment.

🚪 06. Daily Volume Gate Filter

|

Setting |

Value |

|

volGate |

10 (NQ) *Changed |

|

|

50 (ES) *Changed |

|

⏰Trade Time 09abc): *Changed |

First 2 hrs Globex Open (e.g. Eastern Time – start: 18:00:00, end: 20:00:00) |

🔒 Prevents low volume trading based on factor of daily volume sma.

⚙️ SniperPRO ATM Agressive settings profile: highest trade frequency | higher loss risk / return

*Changed = altered from default settings

📌 01. Unique Entry – VolAtrEntry

| Setting | Value |

| Entry Quantity | 1 *Changed |

| Real-time Entries | ✅ Enabled |

| ⏰Trade Time 10a) | First 2 hours RTH (e.g. Eastern Time – start: 09:30:00, end: 11:30:00) |

🧠 VolAtrEntry: This momentum entry type should only be traded during high volume periods for consistency.

🎯 02. Unique Entry – TP1Entry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 20 *Changed |

| Hard Stop Loss | 60 *Changed |

| Dynamic Stop Loss | 60 *Changed |

| Real-time Entries | ❌ Disabled |

🧠 TP1Entry is configured with a tighter profit/stop setup—ideal for scalping.

📈 03. Unique Entry – TrendEntry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 30 *Changed |

| Hard Stop Loss | 90 *Changed |

| Dynamic Stop Loss | 90 *Changed |

| Real-time Entries | ❌ Disabled |

🧠 TrendEntry allows for wider risk/reward—fitting for trending conditions.

💰 04. Profit & Loss Controls

| Setting | Value |

| Daily Profit Target | ✅ Enabled – $1,000 |

| Daily Stop Loss | ✅ Enabled – $1,000 |

🔒 Capital protection and daily goal locking are both active.

🧪 05. Trade Conditions & Filters

| Condition | Status |

| VWMA Positioning Requirement | ✅ Yes |

| TC2 Direction Requirement | ✅ Yes *Changed |

| VolAtr Threshold Requirement | ❌ No |

| SuperTrend Requirement | ✅ Yes *Changed |

| TC Filter 1 Trade Gate | ✅ Enabled |

| TC Filter 2 Trade Gate | ❌ Disabled *Changed |

| Confirmation Bar Entries | ❌ Disabled *Changed |

| Long Entries | ✅ Enabled |

| Short Entries | ✅ Enabled |

| TC Filter 2 Directional Filtering | ❌ Disabled *Changed |

| TC Filter 2 – Short Only Threshold | 8.75 |

| TC Filter 2 – Long Only Threshold | 8.75 |

🔍 Multiple layers of filtering increase signal reliability and market alignment.

🚪 06. Daily Volume Gate Filter

| Setting | Value |

| volGate | 10 (NQ) *Changed |

| 50 (ES) *Changed | |

| ⏰Trade Time 09abc): *Changed | First 2 hrs Globex Open (e.g. Eastern Time – start: 18:00:00, end: 20:00:00) |

🔒 Prevents low volume trading based on factor of daily volume sma.

0⚙️ SniperPRO ATM Trend Only profile: highest probability | high loss risk | high return | probability good

*Changed = altered from default settings

📌 01. Unique Entry – VolAtrEntry

| Setting | Value |

| Entry Quantity | 0 |

| Real-time Entries | ✅ Enabled |

🧠 VolAtrEntry: This momentum entry type is enabled but not actively placing orders (Qty: 0).

🎯 02. Unique Entry – TP1Entry

| Setting | Value |

| Entry Quantity | 0 *Changed |

| Hard Profit Target | 10 |

| Hard Stop Loss | 30 |

| Dynamic Stop Loss | 30 |

| Real-time Entries | ❌ Disabled |

🧠 TP1Entry is configured with a tighter profit/stop setup—ideal for scalping.

📈 03. Unique Entry – TrendEntry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 30 |

| Hard Stop Loss | 70 |

| Dynamic Stop Loss | 70 |

| Real-time Entries | ❌ Disabled |

🧠 TrendEntry allows for wider risk/reward—fitting for trending conditions.

💰 04. Profit & Loss Controls

| Setting | Value |

| Daily Profit Target | ✅ Enabled – $1,000 |

| Daily Stop Loss | ✅ Enabled – $1,000 |

🔒 Capital protection and daily goal locking are both active.

🧪 05. Trade Conditions & Filters

| Condition | Status |

| VWMA Positioning Requirement | ✅ Yes |

| TC2 Direction Requirement | ❌ No |

| VolAtr Threshold Requirement | ❌ No |

| SuperTrend Requirement | ❌ No |

| TC Filter 1 Trade Gate | ✅ Enabled |

| TC Filter 2 Trade Gate | ✅ Enabled |

| Confirmation Bar Entries | ❌ Disabled *Changed |

| Long Entries | ✅ Enabled |

| Short Entries | ✅ Enabled |

| TC Filter 2 Directional Filtering | ✅ Enabled |

| TC Filter 2 – Short Only Threshold | 8.75 |

| TC Filter 2 – Long Only Threshold | 8.75 |

🔍 Multiple layers of filtering increase signal reliability and market alignment.

🚪 06. Daily Volume Gate Filter

| Setting | Value |

| volGate | 100 (% Daily Volume SMA) |

🔒 Prevents low volume trading based on factor of daily volume sma.

⚙️ SniperPRO ATM Gold (GC) profile (thanks to user @kgriffsc): high probability | high-medium return

*Changed = altered from default settings

📌 01. Unique Entry – VolAtrEntry

| Setting | Value |

| Entry Quantity | 0 |

| Real-time Entries | ✅ Enabled |

🧠 VolAtrEntry: This momentum entry type is enabled but not actively placing orders (Qty: 0).

🎯 02. Unique Entry – TP1Entry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 10 |

| Hard Stop Loss | 30 |

| Dynamic Stop Loss | 30 |

| Real-time Entries | ❌ Disabled |

🧠 TP1Entry is configured with a tighter profit/stop setup—ideal for scalping.

📈 03. Unique Entry – TrendEntry

| Setting | Value |

| Entry Quantity | 1 |

| Hard Profit Target | 20 |

| Hard Stop Loss | 60 |

| Dynamic Stop Loss | 60 |

| Real-time Entries | ❌ Disabled |

🧠 TrendEntry allows for wider risk/reward—fitting for trending conditions.

💰 04. Profit & Loss Controls

| Setting | Value |

| Daily Profit Target | ✅ Enabled – $1,000 |

| Daily Stop Loss | ✅ Enabled – $1,000 |

🔒 Capital protection and daily goal locking are both active.

🧪 05. Trade Conditions & Filters

| Condition | Status |

| VWMA Positioning Requirement | ❌ No *Changed |

| TC2 Direction Requirement | ❌ No |

| VolAtr Threshold Requirement | ❌ No |

| SuperTrend Requirement | ❌ No |

| TC Filter 1 Trade Gate | ✅ Enabled |

| TC Filter 2 Trade Gate | ✅ Enabled |

| Confirmation Bar Entries | ✅ Enabled |

| Long Entries | ✅ Enabled |

| Short Entries | ✅ Enabled |

| TC Filter 2 Directional Filtering | ✅ Enabled |

| TC Filter 2 – Short Only Threshold | 8.75 |

| TC Filter 2 – Long Only Threshold | 8.75 |

🔍 Multiple layers of filtering increase signal reliability and market alignment.

🚪 06. Daily Volume Gate Filter

| Setting | Value |

| volGate | 1 (% Daily Volume SMA) *Changed |

|

⏰Trade Time 09abc): |

RTH (e.g. Eastern Time – start: 09:30:00, end: 15:45:00) *Changed |

🔒 Prevents low volume trading based on factor of daily volume sma.

Settings Menu - Calibration

Click on down arrow to open each section

05) VolAtr Threshold, TC2 Trend and SuperTrend Directions Trade Conditions

Four Optional Trade Execution Conditions

In the strategy settings menu 05) Trade Condition, SniperPRO ATM includes four optional filters that must be met to pass the trade execution gate. These conditions help ensure higher-quality setups by aligning entries with market context and trend direction.

📈 1) VWMA Direction Condition (Require VWMA Positioning)

This setting enforces a crossed up/down direction of VWMA fast/slow lines, based on a user-defined lengths of volume weighted moving average values.

- The default lengths are: fast – 8 | slow – 13.

- When fast is crossed over slow: long trade allowed | fast under slow: short trade allowed.

- Directional momentum is typically poised in the direction of crossings.

- Default: On

📈 2) VolATR Threshold Condition (Require VolATR Threshold Minimum)

This setting enforces a minimum Volume/ATR threshold, based on a user-defined multiplier of historical VolATR values collected by time of day.

- The baseline is set to zero.

- Four threshold levels can be configured and mapped to specific time slots.

- Trades are only allowed if the current VolATR meets or exceeds the specified threshold for that time slot.

- Default: Off (only applies to TP1Entry and TrendEntry on bar close entries)

📈 3) Trend Cycle 2 Direction Filter (Require TC2 Trend Direction Condition)

- TC2 is a user-defined trend indicator calculated in real-time on a higher timeframe (default: 15 minutes), with values ranging from 0 to 100:

- A value near 0 indicates an extreme bearish trend.

- A value near 100 signals an extreme bullish trend.

This condition restricts trades to only occur in the same direction as the prevailing trend when TC2 is in extreme zones (typically below 25 for bearish or above 75 for bullish). - Bi-directional trading is permitted when TC2 is within the 25–75 range.

- Default: Off

📈 4) SuperTrend Direction Filter (Require SuperTrend Direction Condition)

This setting allows trades only in the direction of the active SuperTrend trend—bullish or bearish—ensuring entries are made in alignment with the current market momentum.

- Default: Off

05) Trend Cycle Filters Trade Conditions

✅ Optional Trend Cycle Filter Conditions

In the strategy settings menu 05) Trade Condition, SniperPRO ATM includes two optional trend cycle filters that must be met to pass the trade execution gate. These conditions help ensure higher-quality setups by aligning entries with market context and trend direction.

05) Entry Types Conditions

🔄 Real-Time vs Bar-Close Entries

In the strategy settings menu 05) Trade Condition, these optional entry type conditions may be configured

06) Daily Volume Gate Filter

📊 Daily Volume Gate

The Daily Volume Gate ensures trades are only taken when there is sufficient market activity, helping filter out low-volume conditions that can lead to unreliable setups This feature compares:

- The Current Running Volume (accumulated intraday volume)

- Against a Daily Volume SMA (Simple Moving Average of daily volumes over a lookback period)

By using this filter, SniperPRO dynamically restricts trades during below-average volume environments, increasing the reliability of momentum or trend-based entries.

⚙️ Key Settings Explained

✅ Enable Running Volume Filter

- Function: Activates the gate to restrict trades if the current volume is insufficient.

- Purpose: Prevents entries during thin or inactive market conditions.

📆 Lookback Period

- Function: Sets how many previous trading days are used to calculate the Daily Volume SMA.

- Default: 13 days

- Effect: A longer lookback smooths the average; a shorter one makes the threshold more responsive.

📈 Running Volume Threshold

- Function: Sets the minimum required intraday volume as a percentage of the daily SMA to permit trade entries.

Default: 100% (i.e., trade only if current volume equals or exceeds the 13-day average)

07) Trend Cycle Filter

🔁 Trend Cycle Filter – Smoothing Trade Direction

The Trend Cycle Filter is a refined market direction tool based on a modified interpretation of the MACD (Moving Average Convergence Divergence). It outputs a normalized value between 0 and 100, where:

- 0 = Strongly Bearish

- 100 = Strongly Bullish

For simplified tuning, this 0–100 range is rescaled to 0–10, where:

- Lower values = Less restrictive (more signals)

- Higher values = More restrictive (fewer, stronger signals)

📈 Entry Zone Logic

- Long entries: Trigger when trend crosses above 25 → ~2.5 on the 0–10 scale.

- Short entries: Trigger when trend crosses below 75 → ~7.5, or 2.5 again on an inverted scale.

🔧 Default threshold: 2.75 for both long and short filters across both timeframes.

⚙️ Settings Overview

🕒 TC Filter 1 & 2 Time Frames

- External timeframes used for calculating MACD trend cycles.

- Defaults: 5 minutes (TC1) and 15 minutes (TC2)

- Provides multi-timeframe filtering for more reliable trend confirmation.

🎚️ TC Buy/Sell Thresholds (0–10 Scale)

- Each TC filter has separate buy and sell thresholds.

- Higher numbers = stricter conditions, meaning fewer but higher-confidence trades.

- Recommended: Use the same threshold value for both buy/sell.

- Reference: A threshold of 2.5 ≈ crossing over 25 (buy) or under 75 (sell)

08a) Volume Filter Levels

📊 Volume Filter Levels – Adaptive Volume/ATR Gate

The Volume Filter protects momentum-based trades by requiring today’s intraday Volume ÷ ATR to exceed a time-of-day benchmark built from historical data.

How it works

| Concept | Explanation |

| Historical baseline | For every minute of the session, SniperPRO stores the average Volume ÷ ATR over the past N days (default N = 13). That average is treated as 1× baseline. |

| Threshold | You choose a multiple of the baseline that must be reached before entries are allowed. Internally the scale starts at 0 = baseline, so 1.0 means “2× the historical average” and so on. |

| Four daily slots | Up to 4 independent time windows (e.g., Open, Mid-day, Power Hour, Overnight) can each have its own threshold. Default for all four is 1.0. |

Key parameters

- Threshold 1-4 – minimum multiple (0 – ∞). Default 1.0

- Slot 1-4 start / end – optional daily time windows that map each threshold to the parts of the session you care about.

Tip: Keep thresholds aligned across slots when first calibrating; then tighten specific windows where fake breakouts are common.

Settings Menu - Calibration

Click on down arrow to open each section

05) VolAtr Threshold, TC2 Trend and SuperTrend Directions Trade Conditions

Four Optional Trade Execution Conditions

In the strategy settings menu 05) Trade Condition, SniperPRO ATM includes four optional filters that must be met to pass the trade execution gate. These conditions help ensure higher-quality setups by aligning entries with market context and trend direction.

📈 1) VWMA Direction Condition (Require VWMA Positioning)

This setting enforces a crossed up/down direction of VWMA fast/slow lines, based on a user-defined lengths of volume weighted moving average values.

- The default lengths are: fast – 8 | slow – 13.

- When fast is crossed over slow: long trade allowed | fast under slow: short trade allowed.

- Directional momentum is typically poised in the direction of crossings.

- Default: On

📈 2) VolATR Threshold Condition (Require VolATR Threshold Minimum)

This setting enforces a minimum Volume/ATR threshold, based on a user-defined multiplier of historical VolATR values collected by time of day.

- The baseline is set to zero.

- Four threshold levels can be configured and mapped to specific time slots.

- Trades are only allowed if the current VolATR meets or exceeds the specified threshold for that time slot.

- Default: Off (only applies to TP1Entry and TrendEntry on bar close entries)

📈 3) Trend Cycle 2 Direction Filter (Require TC2 Trend Direction Condition)

- TC2 is a user-defined trend indicator calculated in real-time on a higher timeframe (default: 15 minutes), with values ranging from 0 to 100:

- A value near 0 indicates an extreme bearish trend.

- A value near 100 signals an extreme bullish trend.

This condition restricts trades to only occur in the same direction as the prevailing trend when TC2 is in extreme zones (typically below 25 for bearish or above 75 for bullish). - Bi-directional trading is permitted when TC2 is within the 25–75 range.

- Default: Off

📈 4) SuperTrend Direction Filter (Require SuperTrend Direction Condition)

This setting allows trades only in the direction of the active SuperTrend trend—bullish or bearish—ensuring entries are made in alignment with the current market momentum.

- Default: Off

05) Trend Cycle Filters Trade Conditions

✅ Optional Trend Cycle Filter Conditions

In the strategy settings menu 05) Trade Condition, SniperPRO ATM includes two optional trend cycle filters that must be met to pass the trade execution gate. These conditions help ensure higher-quality setups by aligning entries with market context and trend direction.

05) Entry Types Conditions

🔄 Real-Time vs Bar-Close Entries

In the strategy settings menu 05) Trade Condition, these optional entry type conditions may be configured

06) Daily Volume Gate Filter

📊 Daily Volume Gate

The Daily Volume Gate ensures trades are only taken when there is sufficient market activity, helping filter out low-volume conditions that can lead to unreliable setups This feature compares:

- The Current Running Volume (accumulated intraday volume)

- Against a Daily Volume SMA (Simple Moving Average of daily volumes over a lookback period)

By using this filter, SniperPRO dynamically restricts trades during below-average volume environments, increasing the reliability of momentum or trend-based entries.

⚙️ Key Settings Explained

✅ Enable Running Volume Filter

- Function: Activates the gate to restrict trades if the current volume is insufficient.

- Purpose: Prevents entries during thin or inactive market conditions.

📆 Lookback Period

- Function: Sets how many previous trading days are used to calculate the Daily Volume SMA.

- Default: 13 days

- Effect: A longer lookback smooths the average; a shorter one makes the threshold more responsive.

📈 Running Volume Threshold

- Function: Sets the minimum required intraday volume as a percentage of the daily SMA to permit trade entries.

Default: 100% (i.e., trade only if current volume equals or exceeds the 13-day average)

07) Trend Cycle Filter

🔁 Trend Cycle Filter – Smoothing Trade Direction

The Trend Cycle Filter is a refined market direction tool based on a modified interpretation of the MACD (Moving Average Convergence Divergence). It outputs a normalized value between 0 and 100, where:

- 0 = Strongly Bearish

- 100 = Strongly Bullish

For simplified tuning, this 0–100 range is rescaled to 0–10, where:

- Lower values = Less restrictive (more signals)

- Higher values = More restrictive (fewer, stronger signals)

📈 Entry Zone Logic

- Long entries: Trigger when trend crosses above 25 → ~2.5 on the 0–10 scale.

- Short entries: Trigger when trend crosses below 75 → ~7.5, or 2.5 again on an inverted scale.

🔧 Default threshold: 2.75 for both long and short filters across both timeframes.

⚙️ Settings Overview

🕒 TC Filter 1 & 2 Time Frames

- External timeframes used for calculating MACD trend cycles.

- Defaults: 5 minutes (TC1) and 15 minutes (TC2)

- Provides multi-timeframe filtering for more reliable trend confirmation.

🎚️ TC Buy/Sell Thresholds (0–10 Scale)

- Each TC filter has separate buy and sell thresholds.

- Higher numbers = stricter conditions, meaning fewer but higher-confidence trades.

- Recommended: Use the same threshold value for both buy/sell.

- Reference: A threshold of 2.5 ≈ crossing over 25 (buy) or under 75 (sell)

08a) Volume Filter Levels

📊 Volume Filter Levels – Adaptive Volume/ATR Gate

The Volume Filter protects momentum-based trades by requiring today’s intraday Volume ÷ ATR to exceed a time-of-day benchmark built from historical data.

How it works

| Concept | Explanation |

| Historical baseline | For every minute of the session, SniperPRO stores the average Volume ÷ ATR over the past N days (default N = 13). That average is treated as 1× baseline. |

| Threshold | You choose a multiple of the baseline that must be reached before entries are allowed. Internally the scale starts at 0 = baseline, so 1.0 means “2× the historical average” and so on. |

| Four daily slots | Up to 4 independent time windows (e.g., Open, Mid-day, Power Hour, Overnight) can each have its own threshold. Default for all four is 1.0. |

Key parameters

- Threshold 1-4 – minimum multiple (0 – ∞). Default 1.0

- Slot 1-4 start / end – optional daily time windows that map each threshold to the parts of the session you care about.

Tip: Keep thresholds aligned across slots when first calibrating; then tighten specific windows where fake breakouts are common.

Tutorials - Print & Video

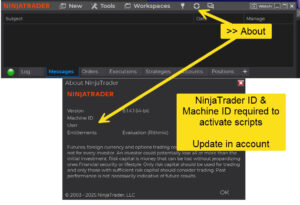

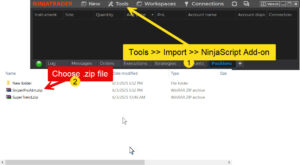

Activation & Installation

Written Instructions

Strategy Settings Overview

Written Instructions

U.I. and Signal Structures

Written Instructions

4, 5: Profit/Stop Loss | Direction

Written Instructions

6: Daily Volume Gate

Written Instructions

7: Trend Cycle Filter

Written Instructions

8a, 8b: Volume Filter Threshold

Written Instructions

8c, 8d, 8e, 8f, 8g: Volume Filter Time Slots

Written Instructions

9a, 9b, 9c: Trading Enabled Time Slots

Written Instructions

10a, 10b, 10c: TrendEntry Time Slots

Written Instructions

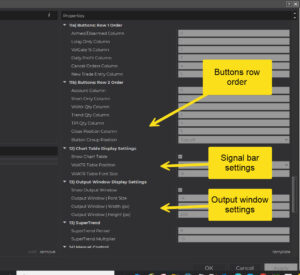

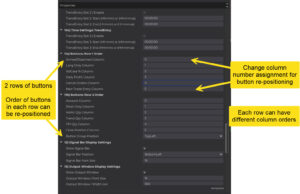

11a, 11b: Button Row Order

Written Instructions

12: Signal Bar Display

Written Instructions

13: Output Window Display

Written Instructions

14: SuperTrend

Written Instructions

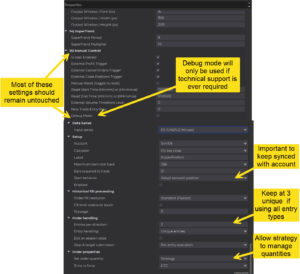

15: Manual Control & Misc

Written Instructions

Manual Entry Buttons

Written Instructions

Tutorial Links

Your are taking the first steps to a new tomorrow for better trading with better tools

Risk Disclosure

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Testimonials

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Live Trade Room

This presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

Virtual Currency

View CFTC advisories as they contain more information on the risks associated with trading virtual currencies.

“NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.”

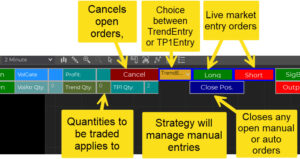

🎯 Long / Short Entry Controls

🎯 Long / Short Entry Controls How It Works:

How It Works: